RSI Capital Markets is a forex brokerage allegedly registered in Montenegro. They claim to be owned by RSI CAPITAL LLC. In the review below, we take an in-depth look at the features Rsiforex.com allegedly offers. The review covers aspects of its licensing, its account types, its leverages, its withdrawal, and deposit methods. Read through our review as we go through what little information we could source to determine if RSI Capital is a scam or not.

Table of Contents

RSI Capital Markets Trading Platform

At first glance, the website seems professional and filled with enlightening information. But on closer inspection, it turns out to be void of the necessary required information.

Rsiforex.com claims to be owned by RSI CAPITAL LLC. Their about page says that the key to their success has been their unsurpassed reputation, which was created through decades of doing business the right way in the leveraged finance markets.

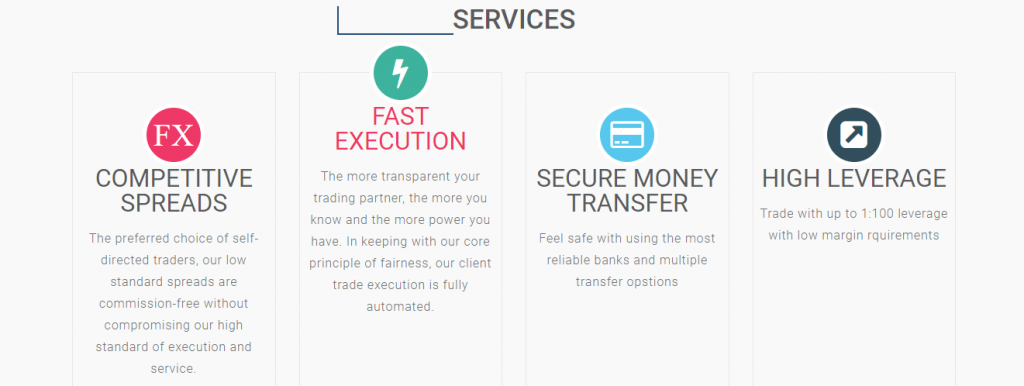

RSI capital claims to support the MT5 trading platform while offering assets such as Forex (with leverages up to 1:100) and CFDs, Indices, Stocks, and Precious metals. They claim that they are soon to integrate Cryptocurrencies into the platform.

They claim to offer other features such as

RSI Capital Markets Account Types

The website doesn’t give any mention of any account type. They don’t state the minimum deposit required when trading. This is something we find very odd, and it doesn’t make them look legitimate to us.

RSI Capital Markets Withdrawal and Deposit Methods

Normally a forex brokerage list options it accepts or supports for depositing and withdrawing. Those methods usually include bank wire, major credit/debit cards, and popular payment options that include: Web money, Visa, Western union, Mastercard, and Bitcoin.

But keeping with the non-disclosure of their account types, they also don’t disclose the payment options they support. This is another thing we find very odd, and it doesn’t make them look legitimate to us.

Is RSI Capital Markets Licensed?

RSI Capital Forex brokerage claims to be owned by a company registered with the name RSI CAPITAL LLC in Montenegro. It gives this License number: 50815144 as its reference number under the Montenegro Ministry of Finance. However, it is common knowledge that the government of Montenegro does not regulate Forex trading and the brokerage giving the registration number of its company.

There is no mention of a European license which can only mean that RSI Capital is providing financial services without proper authorization and is targeting European traders illegally.

So, no, RSI Capital markets is not a licensed Forex Broker.

Trade with TOP RATED BROKERS Instead

Accounts

Free Trial

Projects

SSL

S

Licensed in UK(FCA), Dubai(DFSA), St Vincent and the Grenadines, Cyprus(Cysec) and Cayman Islands

Accepts Traders Worldwide

Minimum Trade Deposit $100

Maximum Leverage

1:500

TOP CHOICE BY TRADERS

Licensed in UK(FCA), Australia(ASIC), Belarus(NBRB) and Canada(IIROC)

Accepts Traders Worldwide

Minimum Trade Deposit $100

Maximum Leverage

1:300

BEGINNER FRIENDLY

Licensed in Australia(ASIC) and Cyprus(Cysec)

Accepts Traders Worldwide

Minimum Trade Deposit $100

Maximum Leverage

1:500

Conclusion

They are several things that make us not like RSI Capital market as a potential Forex broker

Number one is that their claims to be licensed is false. Two is we could not find the terms and conditions of this broker. The terms and conditions of a broker are the most important document in Forex trading. Third, is the lack of information like its account types, its location, and withdrawal methods.

In conclusion, we wouldn’t advise or recommend you to trade with Rsiforex.com as we could not substantiate their claim of being a registered company.

Rsiforex.com is likely a platform run by scammers, trading with them would likely result in you losing your money. There is a tremendous risk on any transactions interested traders may conclude with the brokerage and we deeply recommend they look elsewhere for viable trading options.