Thinking of getting into business with Public Capitals? Here is what you must know about this broker. Carefully read this review to find out if publiccapitals.com is the trading platform you will want to trade with.

Table of Contents

About Public Capitals Broker

Public Capitals is an offshore brokerage company with a lot of promises for traders. The broker is owned by Indigo Flow LLC with an incorporation in St. Vincent & the Grenadines.

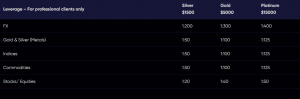

There are different account types Public Capitals offers, namely Silver ($1500), Gold ($5000) and Platinum ($15000).

Added, the broker claims to offer outstanding execution speed, advanced trading tools and 24/5 customer support.

To clarify, in spite the trading instruments Public Capitals claims to offer, traders must know they are dealing with an unknown broker which does not have a regulation over its head.

publiccapitals.com: Reasons to Avoid This Broker

Firstly, publiccapitals.com is a platform with no financial authority overseeing its financial services. The regulation claim is not legit because local financial authority, SVGFSA does not monitors or give license to forex brokers.

Secondly, we noticed publiccapital.com has no demo account for traders. Since traders can’t test Public Capitals on a free account, we can’t know its viability in the forex market.

More so, this broker does not offer money back guarantee which means trading on such platform is clearly a risk as your money cannot be refunded.

These are cons for forex traders to avoid losing money with a scam broker.

Withdrawal and Deposit

Withdrawal process

Under the withdrawal policy, Public Capitals presents its minimum withdrawal amount to be $50.

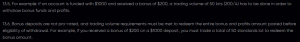

As for the bonus policy, the broker has something to say: for every $200 bonus, traders must meet a trading volume of 50 lots before withdrawal.

Minimum Deposit

Public Capitals minimum deposit is said to be $1500 according to the account type.

As for the payment methods, we can make payment via Credit/ Debit card, Bank Wire Transfer, Union Pay and more. But, you should not consider making any payment with this broker because it is a risk. So beware!

Public Capitals Platform

Public Capitals offers web based trading platform and not MT4 or MT5 (Industry standard trading platforms) which gives us more reason not to take this broker serious.

As for the leverage, it can get up to 1:400. Nevertheless, we say don’t consider doing that with an unregulated forex broker like this one because you stand the chance of losing your money.

Public Capitals Licensing and Regulation

It is not far from believing that this broker is not a licensed brokerage firm. It is not under any financial regulation that means your money is at risk. Its unlicensed and unregulated activities are truly a red flag and must be avoided.

Instead, Trade with TOP RATED BROKERS

Accounts

Free Trial

Projects

SSL

S

Licensed in UK(FCA), Dubai(DFSA), St Vincent and the Grenadines, Cyprus(Cysec) and Cayman Islands

Accepts Traders Worldwide

Minimum Trade Deposit $100

Maximum Leverage

1:500

TOP CHOICE BY TRADERS

Licensed in UK(FCA), Australia(ASIC), Belarus(NBRB) and Canada(IIROC)

Accepts Traders Worldwide

Minimum Trade Deposit $100

Maximum Leverage

1:300

BEGINNER FRIENDLY

Licensed in Australia(ASIC) and Cyprus(Cysec)

Accepts Traders Worldwide

Minimum Trade Deposit $100

Maximum Leverage

1:500

Conclusion: Is publiccapitals.com a Reliable Broker?

No, publiccapitals.com does not seem like a reliable broker for traders even though it promises offers that look good to be true.

Most importantly, the broker is unregulated which means it is not authorized to operate in any regulated country and you should definitely not put any money into it.

Because we have taken it as a duty to review scam forex brokers and also share reasons, we will not recommend this broker for trading.

Kindly share your comment about this broker in the comment section.