Nexo Cap Review: Nexocap Forex broker is another case of an unlicensed broker giving a slew of big promises and boasts. As usual, our review takes an in-depth look at the features, the broker (nexocap.com) allegedly offers. The review covers aspects of its licensing, its account types, its leverages, its withdrawal, and deposit methods. Read through our review to see what we and other experts have to say about Nexocap.

Table of Contents

Nexocap Trading Platform

At first glance, we discover that this broker supports neither the MT4 nor the MT5 trading platform. They use the Activ8 platform and a web-based platform to offer assets such as Forex (with leverages up to 1:500) CFDs, Indices, Stocks, and Precious metals.

Nexocap Account Types

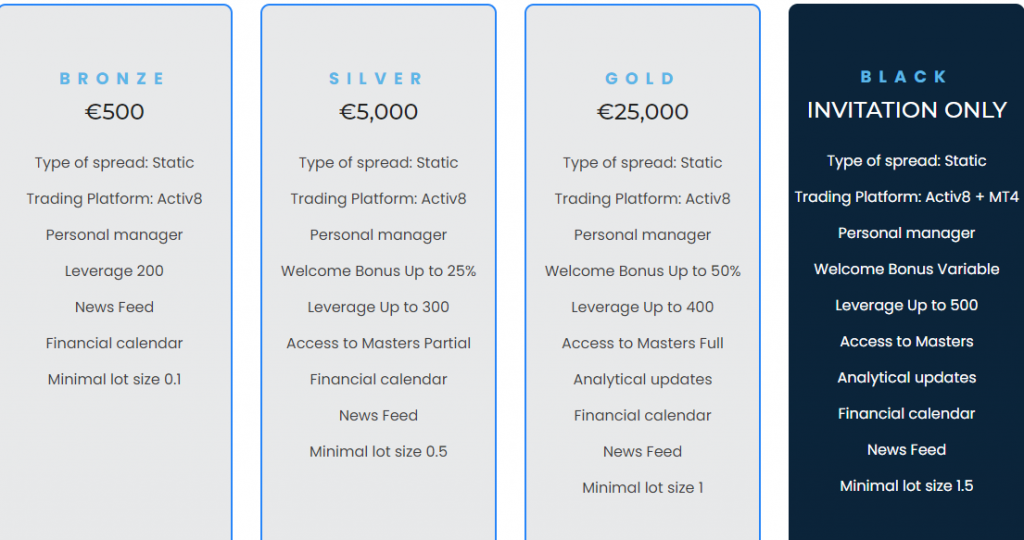

In this portion of the review, we aim to explore the account types a broker might have. We check the account with its corresponding deposit and leverage. Doing this gives a clearer idea how a broker might work.

After checking, we discovered that this broker has four account types.

Nexocap Deposit and Withdrawal Methods

Deposit and withdrawals are the two most important transactions for us because the end goal of trading is making a profit. In this section, we look at these methods to make sure everything is okay with it.

VISA/MasterCard, OK Pay, Alipay.com and wire transfer.

Another thing to keep in mind is that there might also be withdrawal conditions concerning accounts that take advantage of the bonus promotion. Some fraudulent brokers stipulate that a trader must achieve a certain trading volume to be eligible for withdrawal. They do this to stop traders from making a withdrawal.

Is Nexocap Licensed?

Licensing is another important part because we can trust a regulated broker to some extent not to do anything fraudulent. We do this part of the review by first checking the name of the company attached to the broker. Then we run that name through various regulatory bodies to discover if it regulates said brokerage.

This broker claims to be in Saint Vincent and the Grenadines. Saint Vincent and the Grenadines is a place that attracts shady brokers because of their lack of proper licensing laws and a regulatory body. The government of the SVG has stated in the past it does not regulate any form of forex trading.

No, this broker is not a licensed brokerage.

While SVG has no regulatory body, recently the government of Saint Vincent and the Grenadines has claimed that it is planning a complete reformation of the nation’s FX and CFD regulatory grounds. We don’t know when they will do this, but we are expecting SVG to pick up the slack and begin enforcing a set of rules to its broker’s firms, which for now are mostly SCAMMERS.

To get a better understanding of how brokers(both licensed and unlicensed) work, read our review on Fxcryptomine, FTG Markets, Capital GMA, Kiexo.

Trade with TOP RATED BROKERS Instead

Accounts

Free Trial

Projects

SSL

S

Licensed in UK(FCA), Dubai(DFSA), St Vincent and the Grenadines, Cyprus(Cysec) and Cayman Islands

Accepts Traders Worldwide

Minimum Trade Deposit $100

Maximum Leverage

1:500

TOP CHOICE BY TRADERS

Licensed in UK(FCA), Australia(ASIC), Belarus(NBRB) and Canada(IIROC)

Accepts Traders Worldwide

Minimum Trade Deposit $100

Maximum Leverage

1:300

BEGINNER FRIENDLY

Licensed in Australia(ASIC) and Cyprus(Cysec)

Accepts Traders Worldwide

Minimum Trade Deposit $100

Maximum Leverage

1:500

Conclusion

In fact checking this broker, we found that many of its claims were false or unverifiable. We can’t confirm their location, and also, there is a lack of transparency in depositing funds and even a foggier and non-explained process of withdrawing. We don’t advise you to invest with this broker, any attempts to do so we lead to loss of your funds.