Finfuture Forex broker is another case of offshore brokers giving a slew of big promises and boasts. As usual our review takes an in-depth look at the features the broker (Finfuture.co) allegedly offers.The review covers aspects of its licensing, its account types, its leverages, its withdrawal and deposit methods. Read through our review to see what we and other experts have to say about Fin Future.

Table of Contents

Finfuture Trading Platform

This Saint Vincent and The Grenadines’ broker claims to offer assets with a suspiciously high leverage 1:1000. They do not provide the MT4 trader like they claim they do.

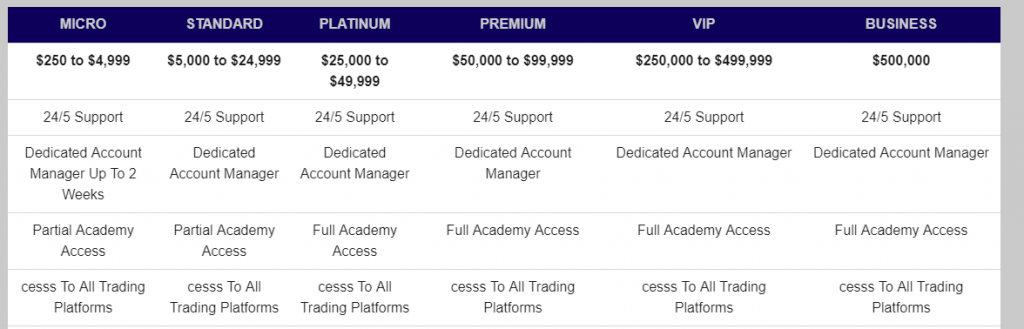

Finfuture Account Types

In this portion of the review, we aim to explore the account types a broker might have. We check the account with its corresponding deposit and leverage. Doing this gives a clearer idea how a broker might work.

After checking, we discovered that this broker has

Finfuture Deposit and Withdrawal Methods

Deposit and withdrawals are the two most important transactions for us because the end goal of trading is making a profit. In this section, we look at these methods to make sure everything is okay with it.

Bankwire or bank card transfer

Another thing to keep in mind is that there might also be withdrawal conditions concerning accounts that take advantage of the bonus promotion. Some fraudulent brokers stipulate that a trader must achieve a certain trading volume to be eligible for withdrawal. They do this to stop traders from making a withdrawal.

Is Finfuture Licensed?

Licensing is another important part because we can trust a regulated broker to some extent not to do anything fraudulent. We do this part of the review by first checking the name of the company attached to the broker. Then we run that name through various regulatory bodies to discover if it regulates said brokerage.

This broker is owned by Hanabishi Partners Ltd., a company that runs various scams. One of their scams, Investactive has been blacklisted with official warnings issued against it by the Spanish CNMV and the Italian CONSOB.

This broker also claims to be in Saint Vincent and the Grenadines. Saint Vincent and the Grenadines is a place that attracts shady brokers because of their lack of proper licensing laws and a regulatory body. The government of the SVG has stated in the past it does not regulate any form of forex trading.

No, this broker is not a licensed brokerage.

While SVG has no regulatory body, recently the government of Saint Vincent and the Grenadines has claimed that it is planning a complete reformation of the nation’s FX and CFD regulatory grounds. We don’t know when they will do this, but we are expecting SVG to pick up the slack and begin enforcing a set of rules to its broker’s firms, which for now are mostly SCAMMERS.

Trade with TOP RATED BROKERS Instead

Accounts

Free Trial

Projects

SSL

S

Licensed in UK(FCA), Dubai(DFSA), St Vincent and the Grenadines, Cyprus(Cysec) and Cayman Islands

Accepts Traders Worldwide

Minimum Trade Deposit $100

Maximum Leverage

1:500

TOP CHOICE BY TRADERS

Licensed in UK(FCA), Australia(ASIC), Belarus(NBRB) and Canada(IIROC)

Accepts Traders Worldwide

Minimum Trade Deposit $100

Maximum Leverage

1:300

BEGINNER FRIENDLY

Licensed in Australia(ASIC) and Cyprus(Cysec)

Accepts Traders Worldwide

Minimum Trade Deposit $100

Maximum Leverage

1:500

Conclusion

We wouldn’t recommend using this forex brokerage, because of the history of the entity that owns it.

In conclusion, we would not advise or recommend you to trade with Finfuture.co , as they don’t give any valid information concerning if they are a regulated broker, Leading us to the conclusion that they are not.

Trading with them would likely result in you losing your money. There is a tremendous risk on any transactions interested traders may conclude with the brokerage and we deeply recommend they look elsewhere for viable trading option.